1.Organize Your Invoices

Having a reliable system in place for tracking your invoices is important, especially if you have many clients and are sending out multiple invoices every month. One way to make sure they don’t get lost in the shuffle is to pay for invoicing software. Another is to keep them saved and organized for free in Bublup. Within the app, you can create a folder specifically for taxes, and within it, a subfolder for invoices. Furthermore, you can create subfolders for each month. After you send out an invoice, make sure to save a copy here!

2.Stay On Top Of Expenses

When it comes time to submit your expenses for the year, don’t get stuck combing through emails or bank accounts trying to find them. Not only will you certainly forget a few, but it is a tedious and time-consuming task. Create another subfolder in your Bublup tax folder for expenses, and be sure to save important emails, receipts, and corresponding documentation as the costs are incurred.

Bublup’s email forwarding feature is a handy way to organize things straight from your email. And if you are on the go, you can use the mobile app’s in-app camera to snap a quick pic of a receipt and save it to a folder.

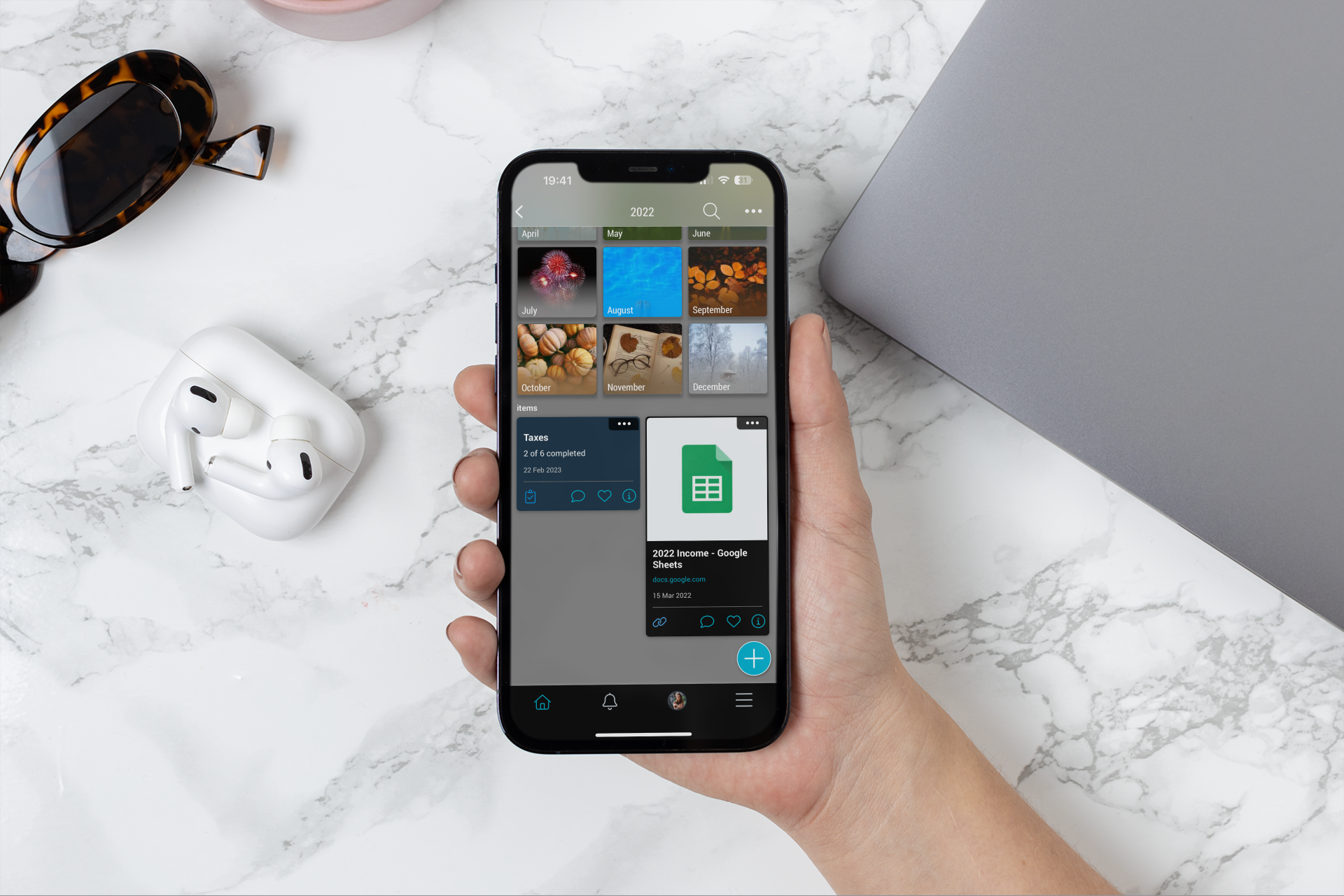

3.Track Your Income

If your income is fairly straightforward and you would rather not spend your hard-earned money on accounting software, there are free ways of tracking your income. For example, Google Sheets is a great option for tracking basic transactions. Create a separate tab for each month, and input the data for every invoice sent. Create a Bublup folder for “Income” and save the link to the spreadsheet so that everything, and we mean everything related to your taxes, is all in one convenient place.

4.Brush Up On Tax Deductions

As a self-employed person, there are many things you can write off as tax deductions. Make sure you know exactly what they are so you don’t leave any money on the table. Intuit has a great guide to get you up to speed. (Don’t forget to save that article in your tax folder!)

5.Set Aside Your Self-Employment Tax

If your earnings from self-employment are more than $400, you are obligated to pay the self-employment tax. (Boo.) Remember- the only way to lower this number is to increase your business-related expenses. Stay on top of those, and you should owe the smallest amount possible.

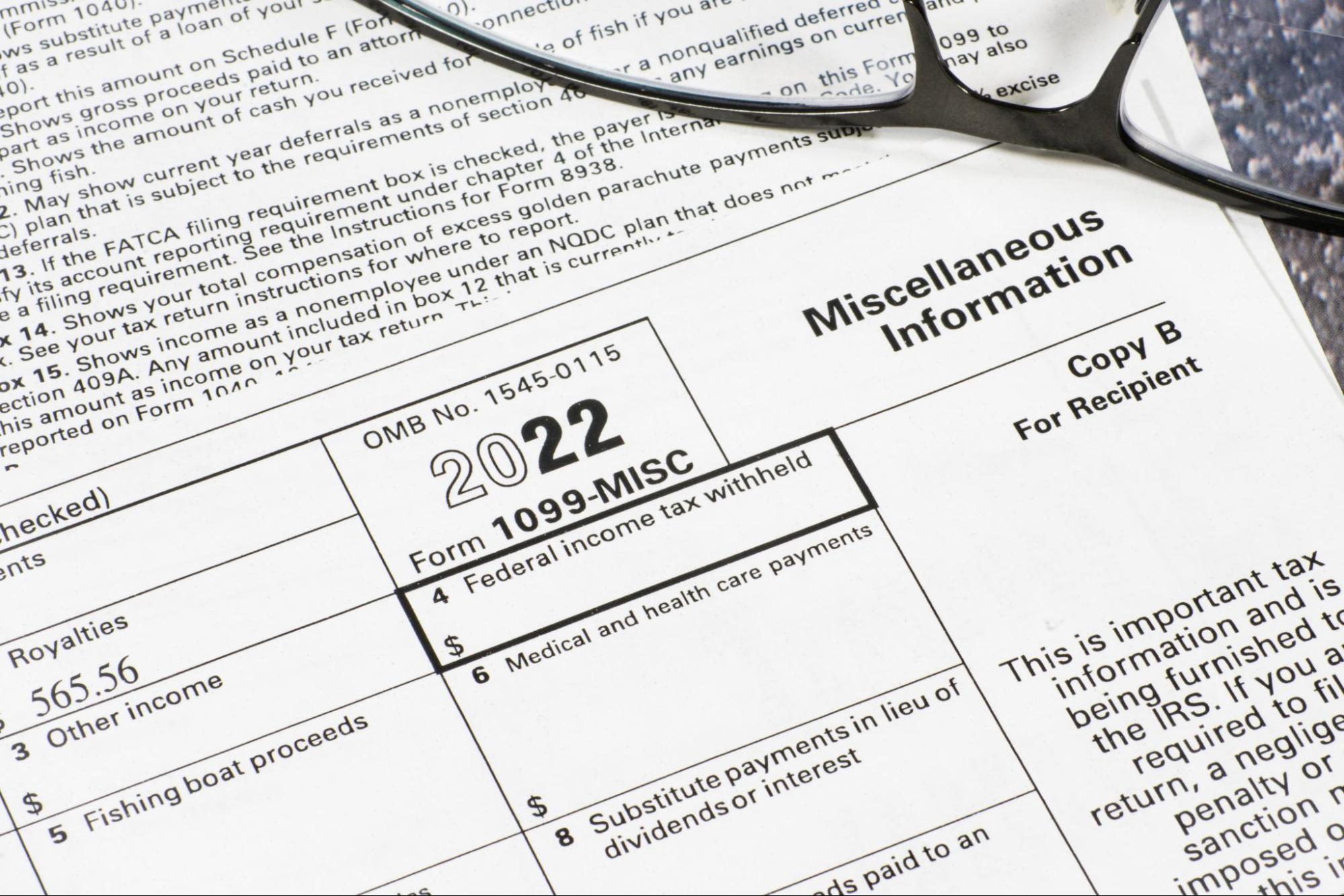

6.Know Your Forms

Special people get special forms and for you that’s going to be the 1099-MISC. If you’re a freelancer, contractor, or otherwise self-employed person, this is what you will be using to report your income. You can save any important tax forms you’ll be needing to a folder for later reference. Get the 1099-MISC here.

7.Plan For Retirement

Since you don’t have a proper employer to set money aside for you, you should know your retirement plan options. Consider a SEP, or Simplified Employee Pension, for example. The money = tax-deferred savings and won’t be taxed until you withdraw it at retirement. The IRS offers helpful information on retirement options here. With all the research you have to do surrounding forms, retirement, etc. it’s really helpful to create a Bublup folder for these informational resources.

8.Research & Choose A Tax Software

With so many tax softwares out there (TurboTax, TaxACT, H&R Block, etc.) it’s important to compare and decide which suits you best. Again, save all of your research into a Bublup folder to help you come to a final decision.

9.Know The Important Dates

A Bublup folder’s notes feature is a handy spot to jot down the important dates to remember. Make sure you know relevant tax deadlines, possible extensions, and any other important dates that affect you in the current tax year. With Bublup’s calendar reminders you can even sync important dates right from your folders to your calendar.

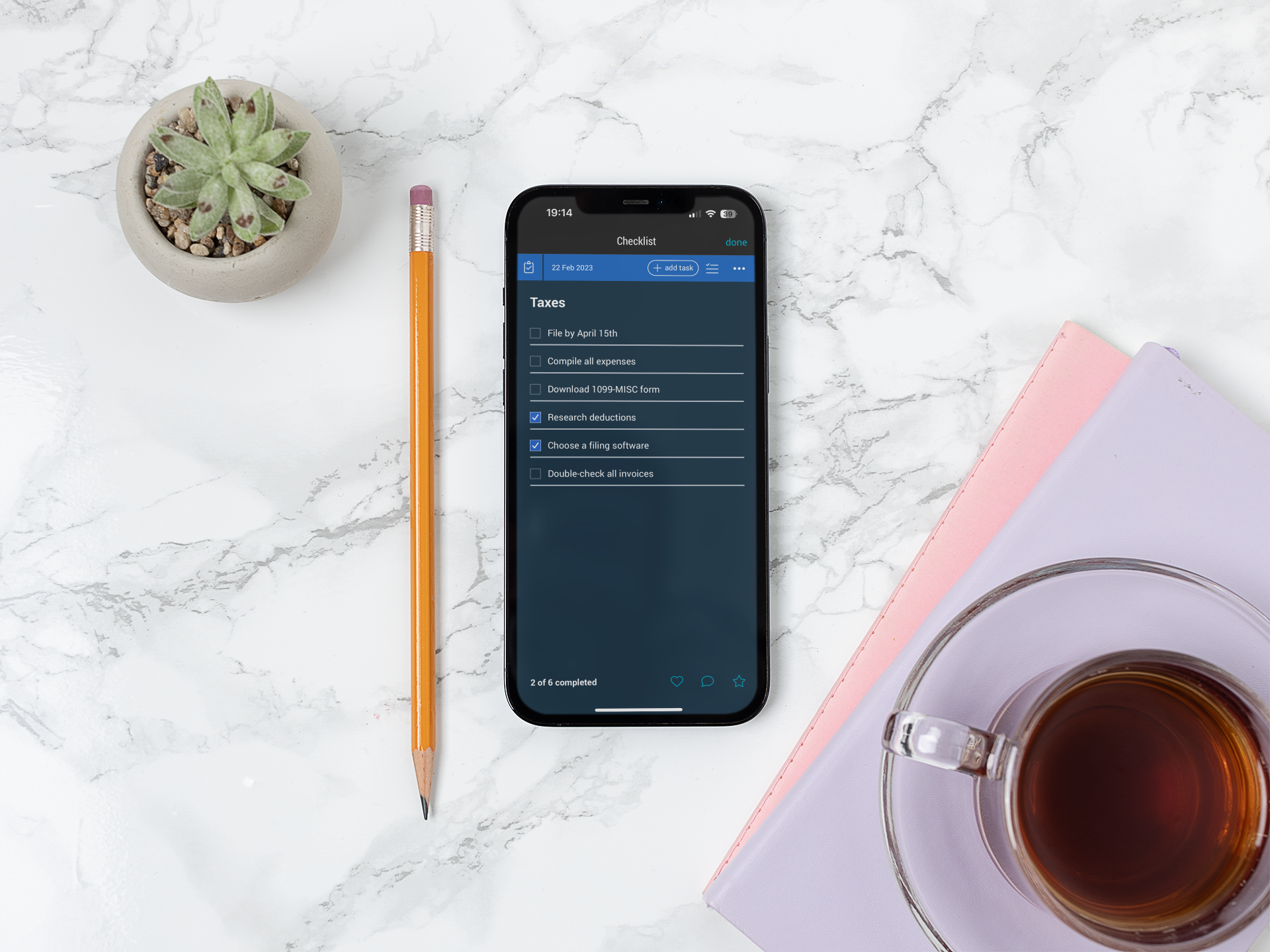

10.Keep A Checklist

Checklists can help you see the big picture and stay focused on what needs to be done. Add the important dates and all the tasks you need to accomplish, from filling out forms to collecting all of your expenses and ultimately, filing your taxes. Nothing makes you feel like your making progress more than checking off items on your list!

Summary

While dealing with your own taxes as a self-employed person can feel daunting, staying organized is the key to making tax season as stress-free as possible. Prepping for taxes has never been easier with the help of Bublup. Save and organize all your links, digital notes, photos, videos, and more in one place. And remember, while taxes are no walk in the park, being self-employed is actually pretty awesome. You’ve got this!